CRA $2460 Pension Supplement December 2025: Even though Canada CRA $2460 Pension Supplement 2025 is not yet official, the discussion around it highlights the actual difficulties facing seniors in 2025. Many Canadian rely on these payments for stability as the country’s aging population increases quickly. If this type of top-up is physicality, it will be deposited regularly with OAS or CPP installments on December 22, 2025. If the government is outstanding your money, you will not have to track it. They will find you. Be intelligent, be safe, and avoid clicking on the link “Confirm your bonus check” that you are watching online.

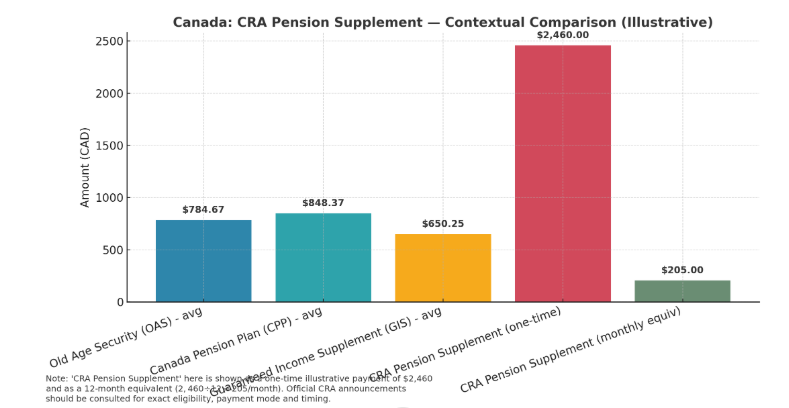

As of now, many Canadians receive a mixture of CPP, OAS, and GIS payments, which can add between $2,400 and $2,500 per month. That monthly plan has been misunderstood by some internet retailers as “a special payment”. In other cases, quarterly inflation adjustments-which occur every January, April, July, October and December-is referred to as a “bonus“, even if they only have regular living adjustments. Therefore, even if the figure is making online rounds, it is not yet a verified government initiative.

CRA $2460 Pension Supplement Highlights

| Item | Details |

| Claimed Amount | $2,460 Pension Supplement (not officially confirmed by CRA or Service Canada) |

| Possible payment date if benefit program is real | December 22, 2025 aligned with scheduled OAS/CPP payments |

| Core benefits involved | Old Age Security |

| Canada Pension Plan | |

| Guaranteed Income Supplement | |

| Inflation Adjustment (Oct–Dec 2025) | + 0.7 % OAS indexation |

| GIS Income Limit (2025) | Single: ≤ $22,440 / year |

| Couple limits vary up to ~$53,808 | |

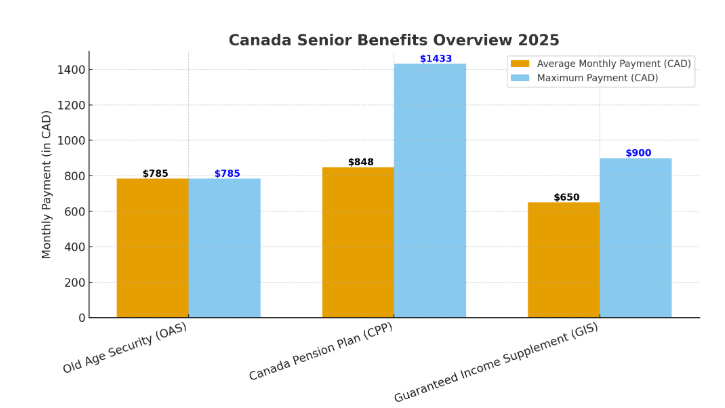

| CPP Max Monthly 2025 | $1,433.00 |

| Average $848.37 | |

| Official Website | https://www.canada.ca/ |

Advice for Financial Planning

Delay CPP: After the age of 65, your pension increases by 8.4% every year.

Mix equipment to save money: Use TFSAS for retirement for tax-free withdrawal and for pre-retirement savings use RRSP.

Budget for inflation: Although official inflation is sometimes extended from personal expenses (such as rent or food), CPP and OAS are adjusted for inflation.

Income Division: Pension alone may not be sufficient. Think about investing, doing part -time working etc.

CRA Pension Supplement Latest Update

The pinch is on the Canadian people. Statistics Canada reports that in 2025, inflation was above 3%, especially for housing and grocery items. Seniors on certain incomes are particularly hard hit. One in four Canadians over 65 has reduced their important expenses. For this reason, rumors of a “$2,460 top-up” even attract attention. Finally, the federal government paid a one-time payment to senior citizens during the epidemic $300 to $500 in 2020). “Can Ottawa do it again?” People ask.

New Canada Pension Plan (CPP) Benefits

To understand any possible supplement, you must understand the basic principles of the system.

Old Age Security: Canadian 65 and above, old age security (OAS) is a monthly stipend and quarterly inflation-indexed. Consumer price increases automatically in response to an increase in index. The OAS rate is currently available here.

Canada Pension Plan, which is based on your contribution and work from work. Maximum monthly payment for 2025: $ 1,433. The average monthly income for a retired is $ 848.37.

Guaranteed Income Supplement: For low-income OAS users, guaranteed income supplement (GIS) is a non-taxable benefit. The marital status and income determines the eligibility. If you have submitted a tax, it has been automatically evaluated every July.

Where is CRA’s $2460 Pension Supplement Fit?

This figure can represent: three months of joint profit. A person who receives approximately $ 820 per month (GIS + OAS) makes around $ 2,460 every three months.

Exceptional increase in cost of life: People confuse quarterly sequencing for payment of the same lump as it accumulates during one year.

Shorthand for media: Some websites have referred to any growth for seniors, even regular people as “pension supplements”.

CRA GST/HST Credit Payment Dates 2025: Check Schedule, Eligibility & Amount

Canada Tech Visa Program Aims to Attract H-1B Rejected Workers

Canada CRA Pension Supplement

CRA $2460 Direct Pension Payment Eligibility

It is reported here that you get every dollar that you deserve, even if this special supplement does not work:

- Log in and reach your service Canada account. Go to MSCA to see your payment dates, recent modifications and OAS/CPP/GIS status.

- On time, enter your taxes. If you do not have any income, then file your return. Depending on tax information, GIS and allowance are automatically renewed.

- Follow any official announcements. You can examine employment and social development Canada (ESDC) press release or go to canada.ca/news.

- The viral post should never be trusted until they have been verified. Pay attention to the payment dates on your calendar.

- The dates of 2025 OAS and CPP deposits are 29 October, 26 November and 22 December. Report unpaid invoice as soon as possible and in the event of contact service Canada 1-800-277-9914 that your deposit is absent or late.

Maximum Payment Amount for Retired Person

According to StatsCan, by mid-2025, average monthly expenses for senior homes were $ 1,390 for housing and $ 1,070 for groceries. When it comes to certain pension, every growth is counted. To compete with inflation, several activists, including the Canadian Association of Retired Persons (CARP), have urged a one -time relief payment for the minor -income seniors. If that assistance is included in the federal budget, an increase of $ 2,460 may be possible.

Common Mistakes to Avoid

- Taking CPP very quickly without considering long -term effects.

- Not applying for GIS, abandoned except free money.

- OAS ignoring the clawback, which can reduce the profit unexpectedly.

- Assuming automated enrollment-Any OAS has no auto-enrolled.

How To Maximize Your Pension Income

- CPP delay if possible. Every month you delay after the age of 65 years, which adds ~ 0.7 % to your profit.

- If you are 65 and less than the lower-age, apply for an allowance or allowance for the survivor.

- Provincial support claims (eg. Ontario Benefits, Alberta Seniors Benefits). Set direct deposit fast, safe, low paper.

- The budget for quarterly sequencing may seem smaller to each increase but adds more than one year.

$4196 VA Disability Benefits 2025: New Payment Dates, Eligibility & COLA Update

Amazon’s $2.5 Billion Settlement Payout: Check Eligibility Criteria

FAQs CRA $2460 Pension Supplement December 2025

The CRA $2460 Pension Supplement is a one-time financial boost planned for eligible Canadian seniors to help offset rising living costs in December 2025.

Eligibility includes Canadian residents aged 65 or older who currently receive Old Age Security (OAS) or the Guaranteed Income Supplement (GIS).

The payment is expected to be deposited directly into beneficiaries’ bank accounts by the third week of December 2025, following CRA’s benefit schedule.

No, eligible seniors receiving OAS or GIS will be automatically assessed and credited by the Canada Revenue Agency.

No, the $2460 Pension Supplement is a separate, non-taxable payment and will not reduce or interfere with your existing benefits.

The CRA bases the $2460 payment on national inflation trends and senior affordability benchmarks, ensuring fair support to low- and middle-income retirees.